Unlock cash with ease! Learn how to unlock Borrow on Cash App with our ultimate guide and get access to funds when you need them most. In this blog post, we’ll guide you through the steps to enable Borrow on your Cash App account, ensuring you can take advantage of this convenient financial tool.

Table of Contents

What is Cash App’s Borrow Feature?

Cash App’s Borrow feature is designed to provide short-term loans to help you cover unexpected expenses or financial gaps. Unlike traditional loans, Cash App Borrow allows you to access cash quickly and easily through your smartphone. It’s an innovative way to manage your finances without the hassle of lengthy approval processes or hidden fees.

How To Unlock Borrow On Cash App

The Cash App’s Borrow feature is a valuable tool for managing your finances, providing quick access to funds when you need them most. If you’re new to this feature or looking to get started, this comprehensive guide will walk you through the entire process. Let’s dive into everything you need to know to unlock and utilize Borrow on Cash App effectively.

Why Use Cash App Borrow?

Cash App Borrow offers several benefits that make it a convenient choice for financial management:

- Instant Access to Funds: Get the cash you need quickly without waiting for lengthy approvals.

- No Hidden Fees: If you repay on time, there are no surprise charges or interest rates.

- Seamless Integration: Borrowing is integrated directly into your Cash App, making it easy to manage alongside your other financial activities.

Key Benefits of Using Cash App Borrow

With Cash App Borrow, you can enjoy:

- Convenience: Access funds directly from your phone whenever needed.

- Flexibility: Borrow only what you need and manage repayments easily.

- No Stress: Avoid traditional loan processes with their often complex terms and lengthy approval times.

Eligibility Requirements for Cash App Borrow

Before you can access the Borrow feature, ensure you meet the following criteria:

- Active Cash App Account: You need a current Cash App account to apply for borrowing.

- Verified Identity and Bank Account: Cash App requires verification of your identity and bank account to ensure security.

- Regular Income: Demonstrating a steady income can improve your chances of qualifying.

How to Check If You Qualify for Cash App Borrow

Determining your eligibility for Cash App’s Borrow feature is an essential step before applying. Here’s a straightforward guide to help you check if you qualify:

Open Cash App

Start by launching the Cash App on your smartphone. Ensure you’re using the latest version of the app for the best experience.

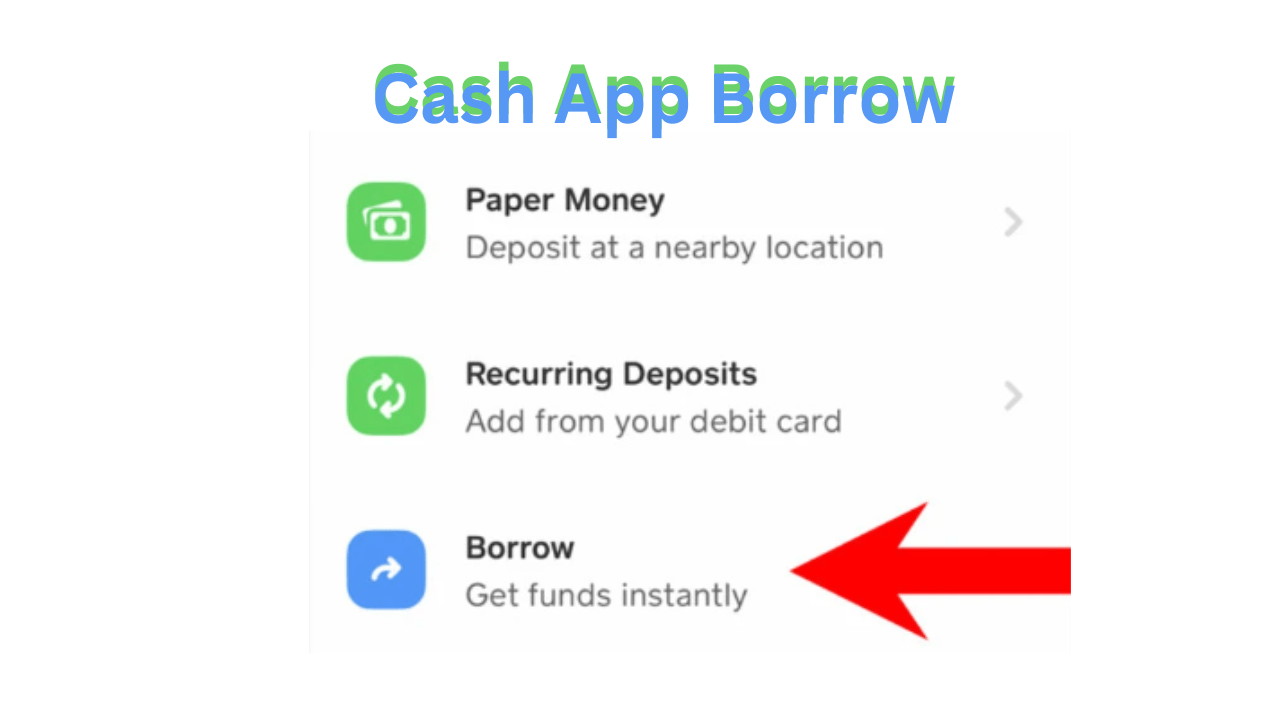

Navigate to the Borrow Feature

- Go to the Banking Tab: Tap on the “Banking” tab, which is typically located at the bottom of the screen.

- Locate the Borrow Section: Scroll through the options to find the “Borrow” feature. It might be listed under a section like “Financial Services” or similar.

Review Eligibility Criteria

- Check for Eligibility Indicators: In the Borrow section, you’ll find information about eligibility requirements. This might include details about having an active Cash App account, verified identity, and linked bank account.

- Look for Qualifying Messages: The app may display messages indicating whether you’re eligible or if further actions are needed.

Confirm Your Eligibility

- Follow Prompts: If the app indicates that you might qualify, follow the prompts to complete any additional steps required for verification.

- Provide Necessary Information: You may need to provide personal details, verify your identity, or link your bank account if not already done.

Contact Cash App Support if Needed

If you encounter issues or have questions about your eligibility:

- Use In-App Support: Access the support feature within the app for guidance.

- Visit Cash App’s Website: Check the website for additional resources or contact options.

How Do I Borrow Money On Cash App?

To borrow money on Cash App, open the app, tap on your balance, and check for the “Borrow” option. If available, select it, choose your amount, and follow the prompts to accept the terms. Funds are typically deposited instantly.

Is Cash App Borrow Available In All States?

Cash App Borrow is not available in all states. Availability depends on your location and state regulations. Currently, it is rolled out to a limited number of users in select states.

What Is The Maximum Amount I Can Borrow On Cash App?

The maximum amount you can borrow on Cash App is typically $200. However, this limit can vary based on your account activity and Cash App’s assessment of your borrowing capability.

How Does The Cash App Borrow Feature Work?

Cash App Borrow allows eligible users to borrow a small loan, usually between $20 and $200. After selecting an amount, users must agree to the repayment terms, which usually involve automatic deductions from your Cash App balance.

What Are The Requirements To Borrow Money On Cash App?

To borrow money on Cash App, you generally need an active Cash App account, regular deposits, and a verified identity. Eligibility may also depend on your location and how frequently you use Cash App services.

Can I Borrow Money On Cash App Without A Credit Check?

Yes, Cash App Borrow typically does not require a traditional credit check. The eligibility is based more on your Cash App usage, direct deposit history, and other internal criteria rather than your credit score.

How Long Do I Have To Repay A Cash App Loan?

Cash App loans generally need to be repaid within four weeks. The repayment schedule is usually divided into installments, and the funds are automatically deducted from your Cash App balance.

What Are The Interest Rates For Borrowing On Cash App?

Interest rates for borrowing on Cash App typically range around 5% for a short-term loan, but this can vary. Always review the specific terms provided in the app before borrowing.

Is Cash App Borrow Safe To Use?

Cash App Borrow is safe to use as long as you understand the terms and can commit to repaying the loan on time. Always ensure that you are borrowing within your means to avoid financial strain.

How Do I Know If I’m Eligible For Cash App Borrow?

Eligibility for Cash App Borrow is determined by factors like your location, account history, and Cash App usage. If you’re eligible, you’ll see the “Borrow” option in the app under your balance tab.

Can I Increase My Cash App Borrow Limit?

Increasing your Cash App Borrow limit isn’t guaranteed, but consistently using Cash App, maintaining direct deposits, and repaying previous loans on time may improve your chances. Cash App adjusts limits based on your account activity.

How Do I Repay A Cash App Loan?

Cash App loans are repaid automatically from your Cash App balance. If funds are insufficient, Cash App may withdraw from your linked bank account. You can also manually make payments within the app.

What Happens If I Can’t Repay My Cash App Loan On Time?

If you can’t repay your Cash App loan on time, you might incur additional fees, and the overdue amount could be automatically deducted from future Cash App balances or linked bank accounts.

Are There Any Fees For Borrowing Money On Cash App?

Yes, Cash App typically charges a flat 5% fee on the amount you borrow. It’s essential to review the specific terms within the app to understand any additional costs.

Can I Borrow Money From Cash App Multiple Times?

Yes, you can borrow money multiple times on Cash App, provided you repay your previous loan on time and meet the eligibility criteria for new loans.

Why Don’t I See The Borrow Option On Cash App?

If you don’t see the Borrow option on Cash App, it’s likely because you’re not currently eligible. Eligibility is based on various factors, including location, account activity, and Cash App’s assessment criteria.

How Is Cash App Borrow Different From Other Payday Loans?

Cash App Borrow typically offers lower fees and shorter repayment terms compared to traditional payday loans. It’s also more convenient, with no need to visit a store or undergo a credit check, making it a more accessible option for quick, small loans.

Can I Use Cash App Borrow For Emergencies?

Yes, Cash App Borrow is designed for quick, short-term financial needs, making it suitable for emergencies. You can instantly access funds and cover urgent expenses like medical bills or unexpected repairs.

How Quickly Can I Get The Money After Borrowing On Cash App?

Funds are typically deposited into your Cash App balance instantly after you borrow, making it a fast option for accessing money when you need it urgently.

Does Cash App Borrow Affect My Credit Score?

Cash App Borrow usually doesn’t impact your credit score since it doesn’t involve a traditional credit check. However, failing to repay the loan could affect your account standing with Cash App.

Can I Borrow On Cash App Without Linking A Bank Account?

No, to borrow on Cash App, you need to have a linked bank account. This is necessary for both depositing the borrowed funds and repaying the loan.

What Happens If I Default On A Cash App Loan?

If you default on a Cash App loan, additional fees may apply, and Cash App may attempt to recover the debt from your balance or linked bank account. Continued non-payment could limit your access to Cash App services.

How Do I Qualify For The Cash App Borrow Feature?

To qualify for Cash App Borrow, you need to have an active Cash App account, regular direct deposits, and meet specific eligibility criteria, such as account history and location.

Are There Any Alternatives To Borrowing On Cash App?

Alternatives to Cash App Borrow include traditional payday loans, credit cards, personal loans from banks, or other cash advance apps like Earnin or Dave. Each option has its pros and cons depending on your needs.

How Do I Apply For A Cash App Loan?

Applying for a Cash App loan is simple. Open the app, tap on your balance, select the “Borrow” option if available, and follow the on-screen instructions to choose your loan amount and accept the terms.

Can I Borrow Money On Cash App If I Have Bad Credit?

Yes, you can borrow money on Cash App even if you have bad credit, as Cash App Borrow doesn’t require a traditional credit check. Eligibility is more focused on your Cash App usage and account activity.

How Does Cash App Determine My Borrowing Limit?

Cash App determines your borrowing limit based on factors like your account activity, direct deposit history, and overall usage of the app. Regular use and maintaining a good standing may increase your limit over time.

What Is The Minimum Amount I Can Borrow On Cash App?

The minimum amount you can borrow on Cash App is usually $20. This small loan option is designed for users who need a quick cash boost for minor expenses.

Is There A Grace Period For Repaying A Cash App Loan?

Cash App Borrow does not typically offer a grace period. Loans are due within a set period, usually four weeks, with payments automatically deducted according to the agreed schedule.

Can I Cancel A Cash App Borrow Request?

Once a Cash App Borrow request is processed, it generally cannot be canceled. It’s important to review the terms carefully before finalizing the loan to ensure you’re ready to commit to repayment.

How Does Cash App Borrow Compare To Cash Advance Apps?

Cash App Borrow offers a straightforward, low-fee borrowing option directly through your Cash App account, while other cash advance apps like Earnin or Dave may offer different terms, fees, or features. Cash App Borrow is often quicker and more integrated.

Can I Borrow Money On Cash App Instantly?

Yes, if you’re eligible for Cash App Borrow, you can access the borrowed funds instantly in your Cash App balance, making it a fast solution for immediate financial needs.

What Is The Cash App Borrow Repayment Plan?

The Cash App Borrow repayment plan typically involves weekly or bi-weekly installments over a four-week period. Payments are automatically deducted from your Cash App balance or linked bank account.

How Do I Set Up Autopay For Cash App Borrow?

Autopay for Cash App Borrow is automatically set up during the loan process. Payments are automatically deducted from your Cash App balance or linked bank account according to the repayment schedule.

What Are The Pros And Cons Of Borrowing On Cash App?

Pros include instant access to funds, no traditional credit check, and low fees. Cons may involve limited borrowing amounts, short repayment periods, and the risk of overdraft if funds are insufficient for repayment.

How Does Cash App Borrow Calculate Interest?

Cash App Borrow usually charges a flat fee rather than traditional interest, calculated as a percentage of the loan amount. For example, a $200 loan might incur a $10 fee, equating to a 5% charge.

Can I Negotiate The Terms Of My Cash App Loan?

The terms of a Cash App loan are fixed and cannot be negotiated. It’s important to review the terms carefully before accepting to ensure they align with your financial situation.

Is Borrowing On Cash App Cheaper Than Payday Loans?

Yes, borrowing on Cash App is generally cheaper than traditional payday loans. Cash App Borrow typically charges a flat fee around 5%, whereas payday loans often come with higher interest rates and additional fees.

Can I Use Cash App Borrow To Pay Bills?

Yes, you can use Cash App Borrow to pay bills. Once the funds are in your Cash App balance, you can transfer them to your bank account or use them directly to pay bills through Cash App.

What Should I Do If My Cash App Borrow Request Is Denied?

If your Cash App Borrow request is denied, check your account status, ensure your information is up-to-date, and try again later. Regularly using Cash App direct deposits may improve your eligibility.

How Do I Get Approved For Cash App Borrow?

To get approved for Cash App Borrow, maintain an active Cash App account, regularly receive direct deposits, and keep your account in good standing. Eligibility is based on your account activity and usage.

Can I Borrow On Cash App Using A Credit Card?

No, you cannot borrow on Cash App using a credit card. Cash App Borrow is based on your Cash App account activity and requires a linked bank account for funds transfer and repayment.

Does Cash App Borrow Offer Customer Support?

Yes, Cash App Borrow offers customer support. You can contact Cash App support directly through the app or website for assistance with any issues or questions related to borrowing.

How Do I Avoid Fees When Borrowing On Cash App?

To avoid additional fees when borrowing on Cash App, repay your loan on time. Review the loan terms carefully, as the initial borrowing fee is generally unavoidable, but timely repayment can prevent extra charges.

Can I Borrow On Cash App Without Direct Deposit?

Direct deposit is typically required to qualify for Cash App Borrow. Regular direct deposits into your Cash App account demonstrate account activity, which is a key factor in eligibility.

How Does Cash App Borrow Compare To Traditional Loans?

Cash App Borrow offers smaller, short-term loans with low fees, making it different from traditional loans that typically involve higher amounts, longer terms, and more stringent credit checks.

Can I Refinance My Cash App Loan?

Cash App Borrow does not currently offer refinancing options. Loans are meant to be short-term, and the terms are fixed, so it’s essential to understand and agree to them before borrowing.

What’s The Repayment Schedule For Cash App Borrow?

The repayment schedule for Cash App Borrow usually involves four weekly installments. Payments are automatically deducted from your Cash App balance or linked bank account according to this schedule.

Can I Borrow On Cash App With A Prepaid Card?

No, you cannot borrow on Cash App with a prepaid card. A linked bank account is required for borrowing, as it allows Cash App to transfer funds and collect repayments.

How Do I Know If Cash App Borrow Is Right For Me?

Cash App Borrow might be right for you if you need a small, short-term loan with low fees and can repay it quickly. Consider your financial situation and alternative options before borrowing.

Can I Use Borrowed Funds From Cash App For Online Purchases?

Yes, you can use borrowed funds from Cash App for online purchases. Once the funds are in your Cash App balance, you can use them like any other Cash App balance to make purchases.

What Should I Consider Before Borrowing On Cash App?

Before borrowing on Cash App, consider the repayment terms, fees, your ability to repay on time, and the impact on your overall financial situation. Borrow only what you can comfortably afford to repay.

Are There Penalties For Early Repayment On Cash App?

No, there are no penalties for early repayment on Cash App. You can repay your loan in full at any time without incurring additional fees, which may save you money on interest.

Can I Transfer Borrowed Money From Cash App To My Bank Account?

Yes, you can transfer borrowed money from Cash App to your linked bank account. Once the funds are in your Cash App balance, initiate a transfer to your bank as you would with any other balance.

How Often Can I Borrow Money On Cash App?

You can borrow money on Cash App as often as you are eligible, provided you’ve repaid any previous loans. Eligibility depends on your account activity and Cash App’s internal criteria.

Can I Borrow More Than Once At A Time On Cash App?

No, you typically cannot have multiple active loans on Cash App simultaneously. You must repay your current loan in full before borrowing again.

How Do I Get Lower Interest Rates On Cash App Borrow?

Interest rates on Cash App Borrow are generally fixed, but maintaining a good account standing, regular direct deposits, and responsible usage might improve your eligibility for better borrowing terms in the future.

Can I Use Cash App Borrow For Business Expenses?

Yes, you can use Cash App Borrow for business expenses. However, ensure that the loan amount and repayment terms align with your business’s cash flow and financial needs.

What Happens To My Cash App Loan If I Close My Account?

If you close your Cash App account before repaying a loan, Cash App will still attempt to collect the debt from your linked bank account. It’s important to settle any outstanding loans before closing your account.

How Do I Increase My Chances Of Getting Approved For Cash App Borrow?

To increase your chances of getting approved for Cash App Borrow, regularly use Cash App, maintain direct deposits, and keep your account in good standing. This consistent activity can improve your eligibility.

Can I Borrow On Cash App During Weekends Or Holidays?

Yes, you can borrow on Cash App during weekends or holidays. The borrowing process is automated and available 24/7, allowing you to access funds whenever you need them.

What Are The Common Reasons For Cash App Borrow Rejection?

Common reasons for Cash App Borrow rejection include insufficient account activity, lack of regular direct deposits, and not meeting minimum balance requirements. Also, residing in a state where the service isn’t available or having a poor account standing can lead to rejection.

How Does Cash App Borrow Impact My Spending Limit?

Cash App Borrow does not directly impact your spending limit. However, borrowing might reduce the available balance in your Cash App account, which could limit how much you can spend or transfer until the loan is repaid.

Can I Use Cash App Borrow To Fund Investments?

Cash App Borrow is designed for short-term personal expenses, not for funding investments. It’s best to use borrowed funds for immediate needs rather than long-term investments, which require careful financial planning.

Does Cash App Borrow Offer Flexible Repayment Options?

Cash App Borrow generally has fixed repayment terms with weekly or bi-weekly installments. There aren’t flexible repayment options, so it’s important to ensure you can meet the set payment schedule before borrowing.

How Secure Is My Information When Borrowing On Cash App?

Cash App uses encryption and robust security measures to protect your personal and financial information when borrowing. However, always be cautious and ensure your account is secure with strong passwords and two-factor authentication.

Can I Get A Refund After Borrowing On Cash App?

Refunds are not typically available for Cash App Borrow. Once borrowed funds are disbursed, they are meant to be used for the intended purpose and repaid according to the loan terms.

How Do I Manage My Cash App Borrow Account?

Manage your Cash App Borrow account through the app by reviewing your loan details, checking repayment schedules, and monitoring your balance. You can also set up notifications to stay updated on your loan status.

Are There Hidden Fees With Cash App Borrow?

There are no hidden fees with Cash App Borrow. The fee structure is transparent, usually involving a flat fee or a small percentage of the loan amount, which is disclosed before you accept the loan terms.

Can I Borrow On Cash App Without Providing Personal Information?

No, you cannot borrow on Cash App without providing personal information. Cash App requires basic personal details and account information to process and approve your loan application.

What Is The Minimum Credit Score For Cash App Borrow?

Cash App Borrow does not require a minimum credit score as it does not perform traditional credit checks. Eligibility is based more on your account activity and direct deposit history rather than your credit score.

Can I Use Cash App Borrow For Personal Expenses?

Yes, Cash App Borrow can be used for personal expenses like bills, groceries, or emergencies. It’s designed to provide quick access to funds for short-term financial needs.

How Do I Check My Cash App Borrow Balance?

To check your Cash App Borrow balance, open the Cash App, tap on the “Borrow” option if available, and view the details of your current loan and any remaining balance or repayment schedule.

Can I Borrow On Cash App If I’m Self-Employed?

Yes, you can borrow on Cash App if you’re self-employed, as long as you meet the eligibility requirements, such as having an active Cash App account and regular direct deposits. Your account activity is key.

How Often Does Cash App Update My Borrow Limit?

Cash App updates your borrow limit periodically based on your account activity, direct deposits, and overall usage. Regular use and consistent deposits may increase your borrowing limit over time.

What Are The Tax Implications Of Using Cash App Borrow?

Generally, using Cash App Borrow does not have direct tax implications, as it’s considered a short-term loan. However, consult a tax professional to understand any potential impacts based on your overall financial situation.

How Do I Contact Cash App Support For Borrowing Issues?

To contact Cash App support for borrowing issues, open the Cash App, navigate to the “Profile” tab, and select “Cash App Support.” You can chat with a support representative or find additional contact options for assistance.

Can I Use Cash App Borrow For Medical Bills?

Yes, you can use Cash App Borrow to cover medical bills. Once you receive the borrowed funds in your Cash App balance, you can transfer them to your bank account or use them to pay medical expenses directly.

Is There A Credit Limit For Cash App Borrow?

Cash App Borrow does not have a traditional credit limit. Instead, your borrowing limit is determined by your account activity, including regular direct deposits and your overall account standing.

How Do I Avoid Overdraft Fees With Cash App Borrow?

To avoid overdraft fees, ensure your Cash App account has sufficient funds to cover your loan payments. Regularly monitor your balance and set up alerts to track your account activity and avoid negative balances.

What Documentation Is Needed For Cash App Borrow?

You typically need minimal documentation for Cash App Borrow. Ensure you have an active Cash App account, and regularly receive direct deposits. Basic personal information is required, but extensive documentation is usually not necessary.

Can I Use Cash App Borrow For Rent Payments?

Yes, you can use Cash App Borrow for rent payments. Transfer the borrowed funds to your bank account and then use them to pay your rent or use the funds directly if your landlord accepts Cash App payments.

What Are The Repayment Terms For Cash App Borrow?

Repayment terms for Cash App Borrow usually involve weekly or bi-weekly installments. The exact schedule and amount will be outlined in the loan agreement, with payments deducted from your Cash App balance or linked bank account.

Can I Set Up Payment Reminders For Cash App Borrow?

Cash App does not currently offer built-in payment reminders for loans. It’s a good idea to set up personal reminders on your phone or calendar to ensure you make payments on time.

Does Cash App Borrow Offer Financial Counseling?

Cash App Borrow does not offer financial counseling services. For financial advice or counseling, consider consulting with a financial advisor or counselor who can provide personalized guidance.

Can I Use Cash App Borrow To Consolidate Debt?

Cash App Borrow is not designed for debt consolidation. It’s intended for short-term, personal use, so consider other financial products specifically aimed at debt consolidation if you need to manage multiple debts.

How Do I View My Cash App Borrow History?

To view your Cash App Borrow history, open the Cash App and navigate to the “Borrow” section if available. Review your loan details, repayment history, and any outstanding balances within this section.

Are There Rewards For Repaying Cash App Borrow On Time?

Cash App does not offer rewards for repaying your borrowings on time. However, timely payments may positively impact your eligibility for future loans and maintain good standing with Cash App.

Can I Use Cash App Borrow To Build Credit?

Cash App Borrow does not report to credit bureaus, so it won’t directly impact your credit score. For building credit, consider other financial products that report your payment history to credit agencies.

How Does Cash App Borrow Compare To Other Microloan Options?

Cash App Borrow offers small, short-term loans with simple terms and low fees. Compared to other microloan options, it typically has more straightforward access and fewer requirements, but always compare features and costs to find the best fit.

Conclusion

Cash App Borrow offers a convenient and straightforward solution for short-term financial needs, with easy access and minimal requirements. It’s ideal for addressing immediate expenses like bills or emergencies. With fixed repayment terms and transparent fees, it provides a clear borrowing process. However, it’s important to consider that it doesn’t impact your credit score or offer extensive repayment flexibility. Always ensure you can meet the repayment terms and use borrowed funds responsibly to make the most of this financial tool.