Are there things you need to know about “Celsius loan”? If you say YES, not only will this post answer many of your questions but many others related to the Celcius loan.

So.

Table of Contents

Celsius Loan

Celsius loan is a cash advance you receive in USD against the cryptocurrency amount you transferred to Celsius Network as collateral through Defi. It is available via PC, iOS, and Android mobile apps. No credit checks, closing costs, or background checks are required.

In case you are wondering,

Celsius Cypto Loan

A. How Does It Work

Celcius loan provides hassle-free financing with a simple choice of amount, interest rate, and payment schedule. Here is how it works in 6 steps:

- Head over to the Celsius website

- Pick the USD or your currency of choice

- provide the amount you are borrowing

- Select collateral & Interest rate

- Choose the duration of your loan

- Validate your details and get approval.

Keep in mind that your cryptos on deposit serve as collateral for the loan. Even when you’re repaying, your coins will continue to grow in value. You do not need to liquidate for your deposit to yield interest.

And What are the,

B. Countries Where Celcius Loan Is Available

If you live in the US make sure to check if Celsius loan is provided in your state by checking it on the app. According to the company, the app is currently available in more than 200 countries. By securing their crypto holdings with Celsius, US app users can borrow between 25% and 50% of their crypto’s value in USD.

Celsius’ KYC (know your customer) rules mandate that U.S. citizens produce a Social Security number and a picture ID. You’ll need to deposit money into your account once your identification has been verified. An ACH transfer can be used to move funds from your bank. You may also buy any of Celsius’ 10 accepted cryptocurrencies straight from Celsius’ two marketplaces for direct deposit.

It features a very simple dashboard to track deposits, withdrawals, and earnings. This is probably something the company will need to look into in the future.

Instant interest payments are put straight into your bank account every Monday, so you can begin earning interest right now! In addition to crypto-based loans, fee-free withdrawals, and direct payments to family and friends, the app offers a variety of additional financial services.

Celsius Loan Rates

Celsius Loan rates vary from 13.99% APY for US residents to 17.78% APY for non-Us residents

Celsius Loan California

More money means more opportunities for pleasure in California. You have been patiently waiting, and now it is finally available to you. California residents can now apply for loans from Celsius. You may receive the finances you need for the life you really want to live in California by borrowing with 0% APR against more than 40 different cryptocurrencies.

Celsius Loan Faq

In case you are looking for Celsius loan faq, here it is:

Is Celsius loans available in California?

Absolutely, Celsius loans are now accessible in California. You are free to borrow against any of the 40 plus cryptocurrencies available on the platform.

Can you borrow on Celsius in the US?

Yes, you can. Celsius will offer you a lower APY if you are able to prove that you are a US resident and also allow you to borrow in USD.

Does Celsius do a credit check?

No credit checks are Required. Celsius does not carry out or perform credit checks on consumers who are seeking loans through its online platform. Furthermore, a user’s credit score will not be impacted by any action that occurs within their Celsius account.

How much can you borrow with Celsius?

Borrowers may leverage over 30 different cryptocurrencies to borrow $100 or more in USDT, GUSD, USDC, DAI, PAX, or TUSD using the Celsius platform. The loan amount must be denominated in one of those currencies. Applicants seeking loans of $15,000 or above can take advantage of Celsius’s US dollar loans, which are given by the company.

Celsius Loan Bonus

Celsius will credit your account with a bonus between August 1 and August 8, 2022. If you pay off your loan in less than six months, the bonus you were promised will not be paid out. There is a restriction of one bonus per user; however, if a user takes out more than 1 loan that qualifies for the bonus, that user will only earn one bonus depending on the total amount borrowed.

Celsius Loan Review

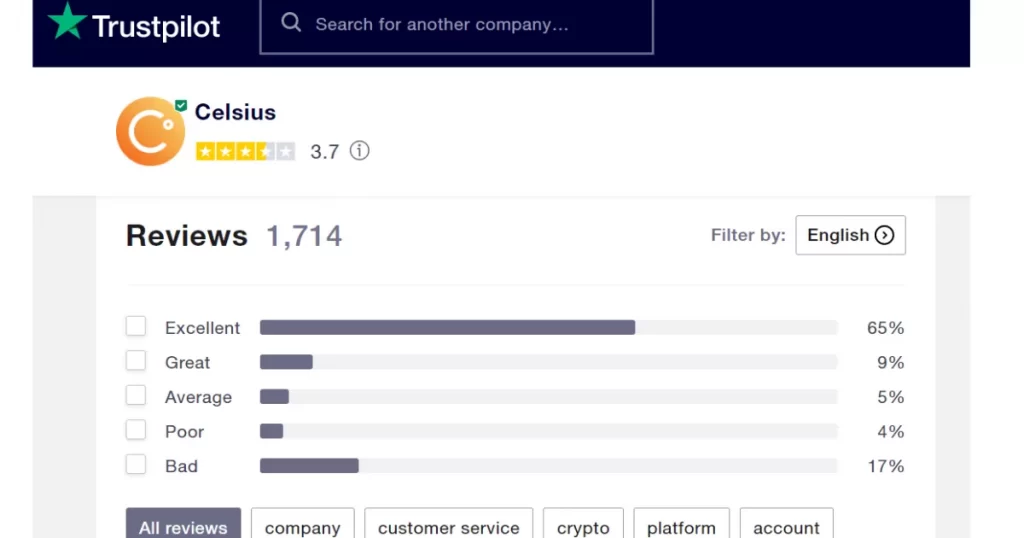

As of August 1st 2023, as shown in the screenshot below, Celsius loan has been reviewed 1,741 times. 65% of borrowers confirmed that the company has excellent service, 9% think their service is great. While 5% think it is average, 4% think it is poor and 17% think it is bad.

What Is A Celsius Loan?

A Celsius loan allows users to borrow funds by using their cryptocurrency as collateral. This enables individuals to access cash without selling their digital assets, making it a practical option for those who believe in the long-term value of their cryptocurrencies.

How Do You Apply For A Celsius Loan?

To apply for a Celsius loan, you need to create an account on the Celsius Network, deposit your cryptocurrency as collateral, and specify the loan amount. The platform will then evaluate your collateral to determine the loan terms and interest rates.

What Are The Requirements For A Celsius Loan?

To qualify for a Celsius loan, you must have a verified account, deposit sufficient cryptocurrency as collateral, and meet any specific loan-to-value (LTV) ratio requirements set by Celsius. Generally, a minimum collateral amount is required to secure your loan.

What Types Of Collateral Can You Use For A Celsius Loan?

Celsius accepts various cryptocurrencies as collateral for loans, including Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDC. The accepted collateral types may vary based on market conditions and updates from the Celsius Network.

What Is The Loan-To-Value Ratio For Celsius Loans?

The loan-to-value (LTV) ratio for Celsius loans typically ranges from 25% to 50%. This means that if you provide $2,000 worth of cryptocurrency as collateral, you can borrow between $500 and $1,000. A lower LTV ratio generally results in lower interest rates.

What Are The Interest Rates On Celsius Loans?

Interest rates on Celsius loans vary based on the LTV ratio and the type of collateral used. Rates can range from 1% to 8.95%, depending on market conditions and individual circumstances. Always check the latest rates on the Celsius platform before borrowing.

How Long Can You Borrow Money From Celsius?

Celsius offers loans with terms ranging from six months to three years. Borrowers can select their preferred loan duration when applying, allowing flexibility based on their financial needs and repayment capabilities.

How Do You Repay A Celsius Loan?

Repayment of a Celsius loan typically involves paying only the interest monthly during the loan term. The principal amount is due at the end of the loan period. Ensure you understand your repayment schedule to avoid any issues.

What Happens If You Default On A Celsius Loan?

If you default on a Celsius loan, your collateral may be liquidated to cover the outstanding debt. This means that if you fail to repay or maintain sufficient collateral, Celsius can sell your deposited cryptocurrency to recover their funds.

Can You Refinance A Celsius Loan?

Yes, you can refinance a Celsius loan by contacting customer support. If interest rates decrease or your financial situation changes, refinancing may help you secure better terms or lower monthly payments.

Is There A Minimum Loan Amount For Celsius Loans?

Yes, the minimum loan amount on the Celsius Network is typically $1,000. This requirement ensures that borrowers have adequate collateral and aligns with the platform’s lending practices.

How Does Celsius Determine Loan Eligibility?

Celsius determines loan eligibility based on several factors, including the value of your collateral, your account verification status, and adherence to LTV ratio requirements. Meeting these criteria is essential for securing a loan.

What Are The Benefits Of Using Celsius For Loans?

Using Celsius for loans offers several benefits, such as accessing cash without selling your cryptocurrency, competitive interest rates, and flexible repayment terms. Additionally, it provides a quick and straightforward application process for borrowers.

Are There Any Fees Associated With Celsius Loans?

Celsius does not charge fees for wallet replenishment or early loan repayment. However, borrowers should be aware of potential market fluctuations affecting their collateral value and associated risks.

How Does The Collateralization Process Work On Celsius?

When taking out a loan on Celsius, you deposit your chosen cryptocurrency into a secured wallet as collateral. The platform assesses its value to determine how much you can borrow while ensuring that your assets are protected during the loan term.

Can You Withdraw Your Collateral While The Loan Is Active?

No, you cannot withdraw your collateral while a loan is active. Your cryptocurrency remains locked until the loan is fully repaid. This policy protects both borrowers and lenders by ensuring that sufficient collateral is maintained throughout the borrowing period.

How Does Market Volatility Affect Your Celsius Loan?

Market volatility can impact your Celsius loan by affecting the value of your collateral. If the price of your deposited cryptocurrency drops significantly, you may need to add more collateral or face liquidation risks if it falls below required levels.

What Should You Know About Liquidation Risks With Celsius Loans?

Liquidation risks arise if the value of your collateral falls below a certain threshold relative to your outstanding loan balance. To avoid liquidation, monitor market conditions closely and maintain adequate collateral throughout the loan term.

How Does Celsius Ensure The Security Of Your Collateral?

Celsius employs advanced security measures to protect user assets, including encryption protocols and cold storage solutions for cryptocurrencies. These measures help safeguard your collateral against theft or unauthorized access while using their platform.

Can You Use Multiple Cryptocurrencies As Collateral For One Loan?

Currently, each individual loan on the Celsius Network requires a single type of cryptocurrency as collateral. However, you can take out multiple loans using different cryptocurrencies if needed.

How Do You Monitor Your Loan Status On Celsius?

You can monitor your loan status through the Celsius app or website dashboard. This feature allows you to track outstanding balances, interest accrued, and any necessary actions related to maintaining adequate collateral levels.

What Customer Support Options Are Available For Celsius Users?

Celsius offers customer support through email and an online help center with FAQs and guides. Users can reach out with questions regarding loans or account management for prompt assistance from their support team.

Are There Tax Implications When Taking Out A Loan From Celsius?

Taking out a loan from Celsius generally does not trigger immediate tax implications since it is not considered taxable income. However, consult with a tax professional regarding potential implications related to interest payments or liquidation events involving cryptocurrencies.

How Do You Get Started With A Celsius Loan Today?

To get started with a Celsius loan today, create an account on their platform, deposit cryptocurrency as collateral, and apply for a loan following their guidelines. Ensure that you understand all terms before proceeding with your application.

What Are Common Mistakes To Avoid When Using Celsius Loans?

Common mistakes include underestimating market volatility risks affecting collateral value or failing to maintain adequate reserves against liquidation thresholds. Additionally, ensure you fully understand repayment terms before committing to avoid unexpected financial burdens later.

How Do Interest Rates Compare Between Traditional Loans And Celsius Loans?

Interest rates on Celsius loans are typically lower than traditional bank loans due to reduced overhead costs associated with crypto lending platforms. Borrowers often find more favorable terms when using their digital assets as collateral compared to conventional financing options.

Can You Use A Credit Card To Fund Your Loan On Celsius?

No, you cannot use a credit card directly to fund a loan on the Celsius Network. Instead, users must deposit cryptocurrencies into their accounts as collateral before applying for loans through the platform.

What Happens If You Overcollateralize Your Loan On Celsius?

If you overcollateralize your loan on Celsius by depositing more cryptocurrency than required for your borrowing needs, you’ll have additional security against market fluctuations but will also tie up more assets than necessary until repayment is complete.

How Does The Withdrawal Process Work After Paying Off A Loan?

Once you’ve paid off your loan in full on the Celsius Network, you can withdraw your previously locked collateral back into your wallet. Ensure that you’ve completed all necessary repayments before initiating this process for smooth withdrawal operations.

Are There Alternatives To Taking Out A Loan From Celsius?

Yes! Alternatives include traditional bank loans or credit lines; peer-to-peer lending platforms; other crypto lending services like BlockFi or Nexo; or utilizing decentralized finance (DeFi) protocols such as Aave or Compound for borrowing against crypto assets without centralized control.

What Should You Consider Before Taking Out A Loan From Celsius?

Before taking out a loan from Celsius consider factors like current market conditions affecting crypto prices; potential liquidation risks associated with volatility; understanding repayment terms thoroughly; assessing whether borrowing aligns with overall financial goals; and evaluating alternative funding sources available in case needed down line!

How Do You Calculate Your Potential Interest Payments On A Loan From Celsius?

To calculate potential interest payments on a loan from Celsius multiply borrowed amount by applicable annual percentage rate (APR) divided by 12 months—this gives monthly payment amount due until principal balance is paid off completely at end term specified during application process!

Can You Get A Personal Loan Through The Celsius Network?

No! Currently only secured loans backed by cryptocurrency deposits are offered through this platform—personal unsecured loans aren’t available here since they require different risk assessments compared secured lending models utilized within crypto space today!

How Do Fees Compare Between Traditional Lending Institutions And Crypto Lending Platforms Like Celsius?

Fees associated with traditional lending institutions often include origination fees or prepayment penalties—whereas platforms like celsius typically charge no hidden fees whatsoever making them more cost-effective options overall especially when considering lower interest rates offered across board!

What Should New Users Know About Using The Platform Effectively?

New users should familiarize themselves with interface features available within app/website; understand how deposits/withdrawals work; keep track of market trends affecting collaterals’ values regularly; maintain communication lines open via customer support channels whenever questions arise during usage experience!

Is It Possible To Get Instant Approval For A Loan On The Platform?

While instant approvals aren’t guaranteed due diligence processes must still occur before any funds are released—typically users receive notifications regarding approval status shortly after submitting applications based upon provided information verifying eligibility criteria outlined beforehand!

How Often Can You Reassess Your Collateral Value During The Loan Term?

Users should reassess their collaterals’ values frequently—especially during periods marked by high volatility—to ensure compliance with required LTV ratios preventing unnecessary liquidations from occurring due lack thereof maintaining adequate reserves throughout the duration specified initially!

Can You Switch Collateral Types After Taking Out A Loan?

No! Once taken out switching collaterals isn’t permitted—users must either pay off existing ones entirely first before applying new ones altogether ensuring compliance within established guidelines set forth beforehand protecting both parties involved throughout the entire process!