Direct Deposit – The Complete Guide – How it Works And Benefits

Direct deposit is a method of electronic payment that allows funds to be transferred directly from one bank account to another. This payment method is often used by employers to pay their employees’ wages or by government agencies to distribute benefits.

Table of Contents

How Direct Deposit Works

To set up direct deposit, the employee or recipient must provide their employer or agency with their bank account and routing numbers. The employer or agency then initiates the direct deposit transaction, which sends the funds directly to the recipient’s bank account. The funds are usually available for withdrawal on the same day the transaction is initiated.

In case you go to the bank to set up a direct deposit, you will need to fill out a direct deposit form.

What Is A Direct Deposit Form

The direct deposit form is used to set up a recurring electronic deposit of funds, such as a paycheck or government benefits. The form typically includes the following information:

Personal information

This includes your name, address, phone number, and email address.

Bank account information

This includes your bank account number and routing number. It may also include the type of account (e.g. checking or savings).

Employer information

This includes the name and address of your employer or organization making the direct deposit.

Signature

You will need to sign the form to authorize the direct deposit.

It’s important to provide accurate information on the form to ensure that the funds are deposited into the correct account.

Key Players Involved in Direct Deposit Transactions

There are several key players involved in direct deposit transactions, including:

- The employer or government agency that initiates the transaction

- The recipient of the funds, who must provide their bank account information

- The recipient’s bank, which receives the funds and deposits them into the recipient’s account

- The Automated Clearing House (ACH), which is responsible for processing direct deposit transactions between banks

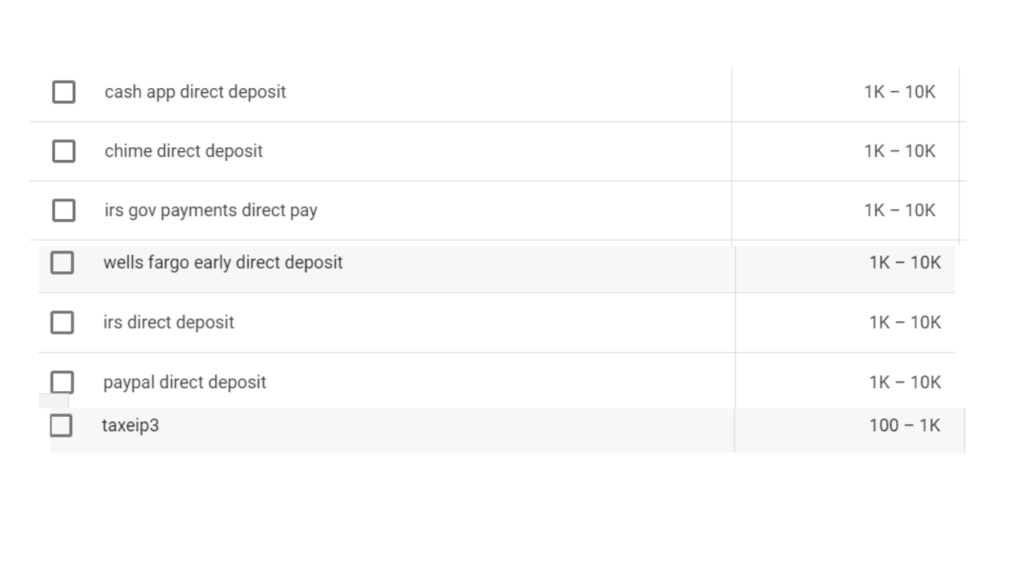

USA 7 Most Googled Direct Deposits

According to Google, Cash app direct deposit, chime direct deposit, irs gov payments direct pay, wells Fargo early direct deposit, IRS direct deposit, Paypal Direct Deposit, Taxeip3 are the

What Information Will You Need To Provide To Your Employer To Set Up Direct Deposit?

To set up direct deposit with your employer, you will typically need to provide the following information:

Your Bank Account Number

This is the unique number assigned to your bank account. You can find this on your bank statement or by logging into your online banking account.

Your Bank’s Routing Number

This is a 9-digit number that identifies your bank and helps direct the funds to the correct account. You can usually find this on your bank’s website or by contacting your bank directly.

The Type Of Account

You will need to specify whether you have a checking or savings account.

Your Name And Address

This should match the information on file with your employer to ensure the funds are deposited correctly.

Your Employer’s Information

This may include the company name, address, and contact information.

Your employer may also provide you with a direct deposit authorization form to complete, which will include all the necessary information they need to set up the direct deposit. It’s important to double-check all the information you provide to ensure that the funds are deposited into the correct account.